If you’re opening a checking account, making a UPI ID, and even buying an insurance coverage plan, you can be requested to submit your KYC or ‘Know Your Buyer’ particulars. However how many people perceive the significance of this course of or know the several types of KYC?

However earlier than stepping into the main points of the assorted varieties of KYC, allow us to perceive what KYC means.

What’s KYC

KYC is used to confirm and authenticate a buyer’s id. Since 2004, the RBI has required all monetary establishments to confirm the id and handle of all clients earlier than conducting monetary transactions with them.

This course of is kind of easy and might be finished in some ways. Extra on this later.

Why is the KYC Course of So Necessary

Listed below are just a few the explanation why KYC is of utmost precedence –

- This course of ensures that unlawful monetary actions are stored in test

- By verifying the shopper’s identities, monetary establishments can stop fraudulent actions and crimes resembling id theft, terrorism financing, cash laundering, and so forth.

- By establishing their identities, banks can even perceive, serve their clients, and consider the dangers concerned in a greater method

When is KYC Required

You’ll be requested to finish the KYC course of for nearly any banking or monetary exercise. Some examples are –

- If you’re opening a checking account, or investing within the financial institution’s mounted deposits, recurring deposits, or every other type of funding.

- Lately, the IRDAI (Insurance coverage Regulatory and Growth Authority of India) made it obligatory for patrons to submit their KYC earlier than getting insurance coverage insurance policies (auto, life, dwelling, journey, and so forth.).

- Additionally, you will want KYC whereas opening every other account resembling a DEMAT and inventory buying and selling account, cellular wallets for on-line transactions, or every other monetary transactions primarily.

Paperwork Required for KYC

With a view to full your KYC course of, you will have a number of of the next OVDs (Formally Legitimate Paperwork) –

- Aadhaar Card

- PAN Card

- Passport

- Driving License

- Voter’s ID

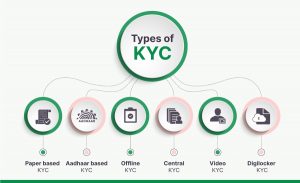

Completely different Sorts of KYC

Now that we’ve understood the significance of KYC, allow us to check out the assorted methods or the a number of channels that can be utilized to finish this course of.

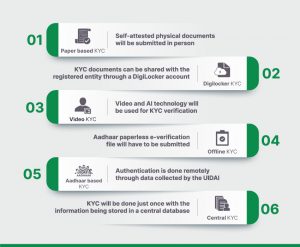

While you submit self-attested, bodily copies of paperwork in individual to finish KYC processes, it is called paper-based KYC or in-person KYC.

The authentication on this case is finished remotely by information collected by the UIDAI. You may go for an OTP – based mostly verification the place an OTP shall be despatched to your Aadhaar-registered cellular quantity. Alternatively you too can choose biometric authentication whereby your biometrics shall be used to confirm your id.

Not like an in-person verification, you’ll have to obtain the Aadhaar paperless e-verification file

and submit this for KYC authentication. You could have to supply consent for the data on this doc for use for verification.

Sure apps resembling moneyview facilitate the KYC course of by this course of. This ensures that clients is not going to should obtain a file individually and share it.

With a view to make the KYC verification course of extra handy, the Authorities of India got here up with this initiative. People should full their KYC simply as soon as with the registered entity, after which the information shall be added to the Central KYC registry (CKYCR) managed by CERSAI.

This report can later be utilized by different registered entities to fetch the KYC info. A 14 digit code shall be generated which can be utilized to entry this report.

Because the identify suggests, your KYC course of shall be accomplished through a video. This feature was permitted resulting from restrictions arising in the course of the pandemic. An auditor and an agent shall be part of this course of and a mixture of video-audio in addition to AI know-how shall be used.

You’ve got the choice to share their KYC paperwork with the registered entity by your digilocker account. Digilocker is a safe cloud-based platform that shops your digital paperwork. This can be a flagship initiative by the Ministry of Electronics and IT.

In Conclusion

If there’s one course of that’s mandatorily required by all monetary transactions, it’s KYC verification. This course of helps to determine your id and permit monetary establishments to grasp your necessities higher. Moreover, the KYC course of additionally ensures safe transactions by stopping fraudulent actions resembling id theft.

The Authorities of India has tried to make the method of KYC verification as seamless as doable and gives numerous methods to get this finished. All you must do is be certain that all of your paperwork are in place and that you simply observe the required steps accurately.