International fertiliser suppliers have made extremely excessive earnings in 2022/23 on the again of value spikes attributed to the Russia-Ukraine conflict. The earnings of the world’s prime 9 producers trebled in 2022 from two years beforehand.

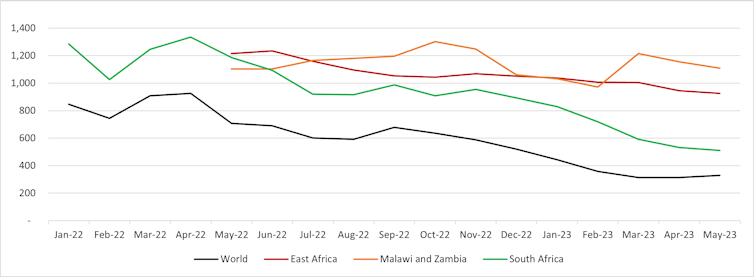

The margins and impacts have been even higher on fertiliser provides to African farmers. Furthermore, the super-high revenue margins are being sustained in 2023 in lots of African international locations even whereas worldwide costs have come down (see determine 1). The harvest season has not too long ago come to an finish in most international locations in southern Africa with farmer margins and manufacturing being squeezed by excessive enter prices.

Supply: Compiled from completely different sources by the African Market Observatory

The broad gaps between fertiliser costs within the area and worldwide fertiliser costs level to main points throughout the provide chain with extra margins of some 30%-80% being earned on gross sales to many African international locations.

South Africa has the advantage of sturdy competitors enforcement which means costs on this nation have come down considerably. This solely serves to focus on the drawback being confronted by farmers in different international locations corresponding to Malawi and Zambia.

Excessive fertiliser costs undermine manufacturing, contribute to excessive meals costs, and exacerbate meals insecurity.

Our work on fertiliser and agri-food markets within the African Market Observatory factors to main issues with how worldwide and regional markets work, together with the market energy of enormous worldwide suppliers. Excessive costs for fertiliser inputs are squeezing African farmers who’re reducing again on fertiliser use which means low yields and provide, and excessive meals costs.

Worldwide motion is due to this fact urgently required on fertiliser costs to enhance meals safety in Africa.

Affect

African international locations are depending on imported fertiliser and utilization is comparatively low. For instance, Kenya and Zambia use round 70kg/ha, in contrast with 365kg/ha in Brazil.

Manufacturing

The harvest season has not too long ago come to an finish in most international locations in southern Africa. There’s proof that farmer margins and manufacturing are being squeezed by excessive enter prices. Excessive prices and low software are a think about maize yields in Zambia being lower than half of these in South Africa and a 3rd of Argentina (in response to the FAO).

In 2022, Kenya imported virtually 30% much less fertiliser and manufacturing fell. Maize output in 2022/23 was 18% decrease than the common for the earlier 5 yr, with yields and space planted each being decrease, compounding the impact of poor rains. This has meant a considerable deficit relative to native demand and really excessive costs.

Continued excessive fertiliser costs will constrain manufacturing, even whereas there’s a nice must develop agriculture output to satisfy regional demand.

For instance, Zambia has plentiful arable land and water for agriculture to extend manufacturing. Of the nation’s 42 million hectares of arable land, solely 15% (or round 6 million) is underneath cultivation, together with for pasture, with just one.5 million of this cultivated for crop manufacturing. Zambia has round 40% of the water assets obtainable for agriculture in your entire SADC area.

If farmers earned higher returns, with cheaper enter prices, then manufacturing may very well be a a number of of the present ranges.

Meals insecurity: Roughly 73 million folks within the East and Southern Africa area are experiencing acute meals insecurity. Folks in low- and middle-income international locations bear the harshest burden – each when it comes to the significance of small-holder farmers and within the vulnerability of low-income city households to excessive meals costs.

Most international locations on the continent depend on meals imports. International locations corresponding to Kenya which have been affected by drought are struggling to supply imports which has worsened meals safety within the nation. This has been exacerbated by export restrictions on maize imposed by Zambia and Tanzania, which have suppressed costs to farmers in these international locations, even whereas enter prices, notably fertilizer, have elevated.

Uneven taking part in area

Worldwide fertilizer costs greater than doubled in two months – from September to November 2021. The height continued into early 2022, reaching a mean value of US$915/t for the benchmark urea fertilizer between March and April 2022. This compares with round US$226 within the earlier 5 years. This was pushed by the world’s largest fertilizer firms making the most of the rise within the value of pure gasoline, an vital enter for nitrogen-based fertilizer, in addition to provide disruptions related to the Russia-Ukraine conflict. The fertilizer firms exploited the shocks and raised costs by greater than the rise in prices.

By March 2023, the worldwide value of urea had fallen again to shut to $300/t. With further prices to import to coastal international locations which needs to be not more than $150/t and to inland areas not more than $250/t together with a dealer margin, South Africa’s inland costs now mirror truthful costs however in different African international locations tremendous earnings are persevering with.

What must be finished

To ease the adversarial impacts of excessive fertilizer costs, governments within the area have tried to implement fertilizer subsidy programmes. For instance, costs in Tanzania with the federal government subsidy have been lowered from round $1100/t to US$600-700/t.

However the subsidies have large prices for governments which many African international locations haven’t been in a position to incur, whereas the programmes have typically not been working effectively. In Malawi, for instance, a big portion of the Inexpensive Inputs Programme (AIP) focused beneficiaries didn’t obtain fertilizer underneath the 2022/2023 programme.

Worldwide motion is due to this fact urgently required on fertilizer costs to enhance meals safety in Africa. First, competitors authorities in Africa ought to examine indicators of anti-competitive conduct. Second, investments are required in logistics, storage and recommendation on optimum utilization. Third, a fertilizer market observatory because the EU is at the moment setting-up would offer ongoing information about fertiliser markets, components affecting them, and change experiences and good practices for optimum utilization.