Cuba goes by its worst financial disaster in 30 years. Since 2020, Cubans have suffered falling wages, deteriorating public companies, common energy outages, extreme shortages and a rising black market. A whole bunch of hundreds of individuals have fled the nation.

Some place the blame for this determined scenario on the door of the Cuban authorities and its mismanagement of the economic system. Others level to the harm attributable to longstanding US financial sanctions that, to various levels, have been in place since 1962.

However which of those is extra true? Each have inflicted financial harm. The US has performed so intentionally, whereas the Cuban authorities’s flawed insurance policies spring from inertia and miscalculation.

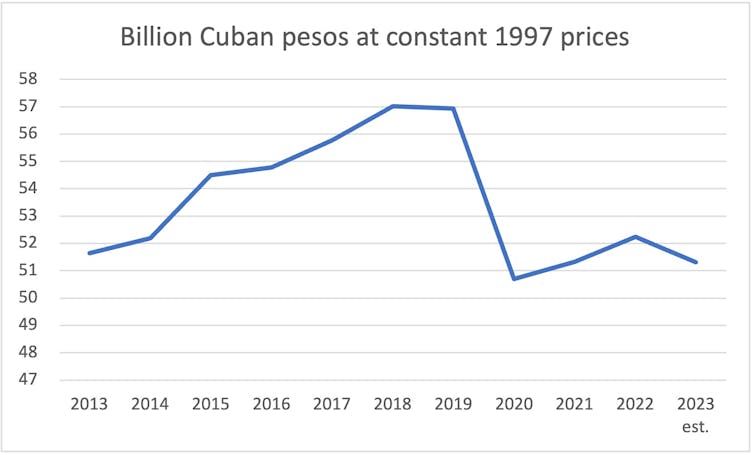

Oficina Nacional de Estadísticas e Información, CC BY-NC-SA

The case in opposition to the federal government

In January 2021, the Cuban authorities launched main forex and value reforms. The reforms, which concerned devaluing the Cuban peso from one to the US greenback to 24 per greenback, had been supposed to start a strategy of aligning Cuban costs with worldwide markets.

The hope was that the transfer would incentivise financial restructuring and innovation to enhance effectivity, scale back dependence on imported items, and finally stimulate exports.

However issues didn’t prove as deliberate. State sector salaries had been greater than trebled in December 2020 to guard dwelling requirements in anticipation of value rises that may end result from the upper value of imports. Nonetheless, this wage improve was rapidly overtaken as greater prices and client spending energy pushed up costs and began an inflationary spiral.

The speed of inflation has eased since then. However the official annual price continues to be alarmingly excessive, at round 30% (greater than twice the Latin American regional common).

The Caribbean has typically skilled robust post-pandemic financial restoration. However Cuba’s nationwide earnings stays effectively under its pre-COVID stage and, with export earnings nonetheless depressed and import dependency unchecked, there’s little signal that any restructuring has occurred.

The impact of US sanctions

The impact of US financial coercion is much less apparent, however no much less important. Cuba has been below a US commerce embargo for the previous 60 years, however a brand new stream of measures was launched below the presidency of Donald Trump (2017–21). Trump’s insurance policies minimize earnings from companies, interrupted gasoline provides, blocked remittances and deterred international funding.

Progress was subdued and shortages had been already beginning to emerge in 2019. However probably the most devastating motion got here in January 2021. One among Trump’s closing acts in workplace – occurring simply days after the forex reform – was to add Cuba to the US listing of “state sponsors of terrorism”.

The impact of this has been big. Interviews that I performed with representatives of international firms doing enterprise with Cuba and with Cuban officers answerable for managing worldwide commerce verify that international companies delayed funds and abruptly cancelled shipments of imports, export contracts and funding plans within the months that adopted.

The resultant provide bottlenecks and lack of international trade supercharged inflation, including to frustration and uncertainty, and stopping restoration.

However maybe Cuba’s best error was to present credence to Joe Biden’s rhetoric in his 2020 US election marketing campaign. Biden spoke about Trump’s “failed Cuba coverage” and vowed to reverse his “dangerous” insurance policies. If that had occurred, a much less tight international trade constraint would have allowed some risk of a constructive provide response to the financial reforms.

Regardless of his marketing campaign guarantees, Biden has left Cuban sanctions in place. This has obstructed Cuba’s entry to international trade, placing the funding required for restructuring out of attain.

jctabb/Shutterstock

Unhealthy timing

The pandemic has additionally contributed to Cuba’s financial turmoil. Cuba responded to COVID by closing its borders and imposing strict lockdowns. This resulted in a pointy financial contraction and a extreme depletion of its international forex reserves.

The pandemic additionally had a dramatic influence on the world economic system. Excessive gasoline and meals costs served to worsen Cuba’s international trade scarcity, and provides had been additional disrupted by logistical bottlenecks and inflated transport prices.

Cuba had really carried out exceptionally effectively in containing the virus all through 2020. However a serious shock got here in 2021 when Cuba grappled with a surge in circumstances of a brand new COVID variant.

US sanctions blocked entry to sources of COVID assist that helped to ease hardships in different nations. Because of this, the federal government had no alternative however to chop funding and was unable to stop the decline in actual salaries.

On the lookout for a manner out of disaster

Discontent fuelled by COVID restrictions and widespread shortages resulted in protests, revealing dissatisfaction with how Cuba’s leaders had responded to those challenges. Officers are seen as having been sluggish to completely acknowledge the federal government’s miscalculations or the diploma of hardship that’s being skilled by Cuban households.

As the speed of inflation step by step eases, the federal government is beginning to define a restoration technique. With no finish to US sanctions in sight, the main focus is on reforming the financial system.

The reforms are wide-ranging, aimed toward tackling the financial distortions and inertia inherited from a long time of strict centralised management. They embrace a gradual discount in value subsidies, extra focused welfare, enhancing the effectivity and responsiveness of state paperwork, and opening as much as non-public companies.

The goal is to stimulate innovation, enhance funding and enhance public companies, which ought to finally elevate progress and enhance dwelling requirements.

However the strategy of restructuring shall be tough. There shall be each winners and losers, and resistance to vary is inevitable. The reform and restoration course of additionally hinges on rebuilding the shaken confidence of the general public and traders, in addition to avoiding additional exterior shocks – or deliberate blows from the US.