The Squeeze Momentum indicator, also referred to as the TTM Squeeze indicator, is a technical evaluation indicator centered on figuring out securities with probably breakouts after prolonged durations of low volatility.

The TTM squeeze indicator is a comparatively new technical indicator launched by John F Carter, a well-known day dealer.

The TTM squeeze indicator makes use of a mixture of Keltner Channels and Bollinger Bands to check common and present volatility, and a momentum oscillator to indicate worth momentum.

What Is the Squeeze Momentum Indicator For?

The Squeeze Momentum indicator is designed to determine securities which might be more likely to quickly get away of an prolonged interval of sideways worth motion.

John Carter’s technique is predicated on all securities ultimately breaking out of durations of flat motion, so it’s only a matter of figuring out when that inevitable breakout will occur.

The Squeeze Momentum indicator tracks the typical and present ranges of volatility to see when the present volatility begins to exceed the typical volatility.

This relative rise in current volatility is a robust sign {that a} breakout in pattern worth motion is about to happen.

The upper the present volatility is in comparison with the typical volatility, the extra probably the breakout is to happen and the stronger the worth strikes are more likely to be.

The momentum oscillator then provides useful data on the worth momentum to measure the depth of the breakout.

Figuring out breakouts upfront offers merchants with a superb alternative to develop trades with very excessive returns and little threat.

A Breakdown of the Squeeze Momentum Indicator

The Squeeze Momentum indicator consists of three elements.

The Keltner Channel and the Bollinger Bands work together to find out the extent of the squeeze impact, and the momentum oscillator reveals the worth momentum.

Most platforms use a histogram to indicate the squeeze impact utilizing dots or crosses as a substitute of truly displaying the Keltner Channel and Bollinger Bands.

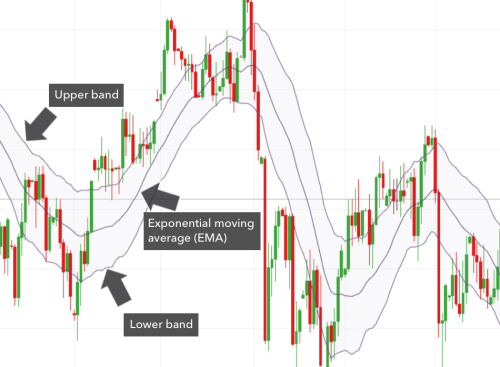

Keltner Channel

The Keltner Channel is a volatility indicator that measures the typical volatility of a safety over a specified time period.

Keltner Channels are composed of three traces.

The middle line is the exponential transferring common (EMA), which is a transferring common that locations larger weight on the newest knowledge factors.

The opposite two traces are 2 deviations of the typical true vary (ATR) from the middle EMA line.

The ATR is a market volatility technical indicator that makes use of situational measurements to finest symbolize a safety’s historic volatility.

To finest mannequin the typical volatility, the ATR makes use of whichever is highest:

- Present Value Excessive – Present Value Low

- Present Value Excessive – Earlier Closing Value

- Present Value Low – Earlier Closing Value

The ATR bands symbolize the historic volatility of the worth from the EMA middle line, giving a extremely detailed picture of the safety’s total common volatility.

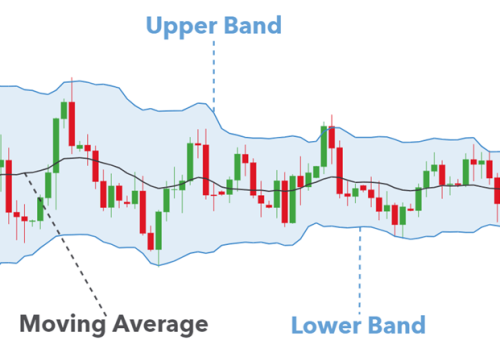

Bollinger Bands

Bollinger Bands are a relatively easy technical indicator invented by John Bollinger that reveals a safety’s present volatility.

John Bollinger created this measure for volatility to be visually intuitive to make use of, which makes it superb for combining with different technical evaluation indicators.

Bollinger Bands are usually set as 2 normal deviations from the straightforward transferring common (SMA) of the safety’s worth.

The larger the volatility of the safety, the additional the Bollinger Bands will prolong from the SMA.

Momentum Oscillator

Most variations of the Squeeze Momentum indicator additionally incorporate an extra indicator within the type of a momentum oscillator.

The momentum oscillator provides to the worth of the TTM Squeeze indicator by displaying the depth of any worth breakouts.

The momentum durations are indicated by a bar graph that rises and falls with the momentum of the worth.

Tips on how to Use the Squeeze Momentum Indicator?

The TTM Squeeze indicator works by combining the knowledge from the Keltner Channel with the knowledge from the Bollinger Bands to show the squeeze impact.

The depth of any breakout from a squeeze is then proven by the momentum oscillator bar graph.

When the Bollinger Bands are contained in the Keltner Channel, that signifies that present volatility is throughout the bounds of historic volatility.

This means a flat motion for the worth.

When the Bollinger Bands push exterior the Keltner Channel, this means that present volatility is exceeding historic volatility.

When present volatility exceeds historic volatility (when the squeeze fires), a breakout is more likely to occur.

The extra the Bollinger Bands exceed the Keltner Channel, the extra probably a breakout is to occur and the larger the breakout is more likely to be.

The momentum oscillator then offers supplemental data, displaying how intense the worth momentum is because the squeeze fires.

Histogram for the Squeeze

Since it could be too disorganized to indicate the Keltner Channel and Bollinger Bands, the squeeze impact of the TTM Squeeze indicator is as a substitute proven on a histogram.

The squeeze impact is demonstrated by coloured dots or crosses, usually purple and inexperienced dots or a black cross for squeeze durations and a grey cross for squeeze launch durations.

For illustrative functions, we are going to use purple and inexperienced dots.

When volatility is low and the squeeze is in impact, the histogram will present purple dots.

When the squeeze launch occurs and volatility is excessive, the histogram will present inexperienced dots.

Use the Squeeze Momentum Indicator to Be taught Extra

One of the best methodology for studying extra about this fashionable indicator is by utilizing it to make actual or simulated trades.

Figuring out potential breakouts from flat pattern instructions is likely one of the highest-return and lowest-risk monetary market analyses that merchants could make.

Merchants who wish to beat market traits are suggested to include this comparatively easy momentum indicator into their toolkit.

TrendSpider is the highest-rated technical evaluation software program, providing the squeeze momentum indicator and plenty of different technical indicators for customers to reinforce their market-beating buying and selling technique.

Be taught Extra About TrendSpider